What do Gold and Crypto have in common?

Gold has been used as a form of currency for centuries. Modern-day historians believe that gold was first used as a currency by the ancient Egyptians, who emphasized the precious metal in their art, jewelry, and other cultural artifacts. Today, gold remains important in our global economy as a valuable store of wealth and a hallmark of economic stability.

The first decentralized cryptocurrency was Bitcoin, released as open-source software in 2009. The novel network is monetized by creating a system where everyone can work together to verify and secure transactions instead of relying on one centralized institution like banks. As of 2022, there were more than 9 thousand cryptocurrencies, of which more than 70 exceeded $1 billion in market capitalization.

So, what do these two seemingly disparate things have in common? And is there a way to combine these two forms of currency? Let's take a closer look.

1. Scarcity

Gold is scarce, and so is crypto. There are only so many units of each in existence, which makes them both valuable.

Although we cannot be entirely sure, most experts believe the world will eventually exhaust its minable gold reserves, but it is unclear when this will happen.

Gold and crypto are both precious due to their scarcity. While the amount of gold in existence is quite finite, a limited number of units still exist at any given time. Similarly, the total supply of crypto is strictly controlled by the various blockchains on which this cryptocurrency is based. Moreover, some cryptocurrencies are deflationary, meaning that over time, their circulating supply decreases, causing an increase in value.

The same principle could be applied to gold. If this resource becomes more sought-after, its value can continue to rise, making it an ideal investment for those who wish to safeguard their wealth against economic downturns and market fluctuations. Although, it all depends on the current market situation, as with any other form of currency.

2. Durability

Gold is considered a highly durable investment due to its high resistance to physical damage. Unlike paper money, which can be easily destroyed through exposure to water or excessive wear, gold physically lasts for years without deteriorating. This makes it suitable for long-term investment strategies, as it can help protect one's assets against unexpected economic crises.

Crypto can be defined as digital money, so its durability is not to be determined in the standard 'physical' form. On the other hand, another problem arises - crypto is very easy to lose.

If a crypto wallet's private keys are lost or stolen, the digital assets in that wallet will be inaccessible forever because of the blockchain's decentralized nature. According to Chainalysis, a leading blockchain data analytics company, it is estimated that 20% of all bitcoins (~$205.8B) are located in wallets whose private keys have been lost. However, this problem is solvable with various digital custody solutions available on the market.

Overall, when it comes to investing for the long term, both gold and crypto offer durable options for securing and preserving assets for years to come.

3. Divisibility

Divisibility in currencies means that you can divide one unit into smaller units, keeping the same value ratio.

Gold remains in its pure form even when it is split into smaller units. For this reason, gold has historically been used as a means of exchange for larger items, such as land or livestock, while being easily divided into smaller units to trade more everyday goods and services.

Cryptocurrencies are based on blockchain technology that allows them to be split into arbitrarily small fractions. This makes them ideal for small purchases, micropayments, and other transactions that would normally be too costly or impractical to conduct using traditional forms of payment. For example, people can easily pay for a cup of coffee or donate using digital coins without wasting paper bills or change. With the rise of the proof of stake (PoS) consensus mechanism, the transaction fees for these smaller transactions are becoming close to zero.

From an investment perspective, divisibility is important because it allows investors to purchase a fraction of an asset rather than the entire asset.

4. Fungibility

Fungibility is the quality of an asset to be able to be replaced by another identical asset. In other words, each unit is interchangeable with another unit, which makes it easy to use as a form of currency.

Since gold is known as a fungible commodity, it is often used as a form of currency. This means that each gold unit is interchangeable, making it easy to transfer between buyers and sellers. Therefore, gold is often measured in grams or ounces.

Cryptocurrencies are also fungible assets, which means that each unit is interchangeable with another. For example, one bitcoin can be traded for another bitcoin, etc. This makes cryptocurrencies easy to use as a form of currency and makes them ideal for investment purposes. While crypto does have intrinsic value due to the unique cryptographic algorithms that make up each individual coin or token, each unit of those tokens can be easily transferred and exchanged between different parties without any loss in value or quality.

Gold meets Crypto?

While gold and crypto may seem like two very different things, they actually have quite a bit in common. They are both scarce, durable, divisible, fungible, and of course, valuable. This makes them both good options to use as a form of currency. But what if we tell you that there is a project incorporating both of these forms of currency?

Meet Apraemio — the first company that combines cryptocurrency with gold mining. Yes, the company has an actual gold mine in Mali, Africa, so your investments are backed by real, freshly acquired gold.

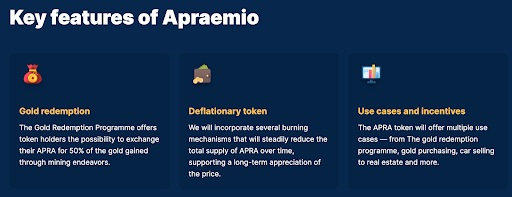

What's unique about this project is that its token APRA can be exchanged for real gold mined through the company's exploration project with an estimated reserve of 100 to 500 tons of gold in Mali, Africa. The gold was discovered after conducting a geological survey using advanced 3D satellite imaging technology. These assets' total market value is estimated at least 5,5 billion EUR.

To incentivize the investors who have helped the project to gain the necessary funds for drilling and mining, 50% of the total gold mined will be distributed among the full supply of 1 billion APRA tokens.

APRA is a utility token released on the Binance Smart Chain according to the BEP20 standard. The token sale will be carried out in three stages: Private sale, Pre-sale and Main Sale. The private sale begins on 15th November 2022.

So why should you be interested in the private sale of APRA?

The main reason is that one APRA token will be valued according to the amount of raw gold mined. In other words, the more gold is mined, the higher the value of one APRA token will be.

For example, by 100 tons of mined gold, half of it (50 tons) will be distributed between token holders. Fifty tons equals 50,000,000 grams, divided by the total token supply of 1 billion, resulting in the token price equivalent to 0.05g of gold. Which approximately values at $3. By 200 tons of mined gold, 1 APRA token will be valued at 0.10 grams of gold or $6, and so on.

Apraemio also encompasses a full-fledged ecosystem with various community rewards and a growing set of multiple use cases unique to the APRA token.

Take advantage of this unique opportunity to participate in the first-ever project of its kind. For more information about the upcoming private sale, please visit the project's website.